Table Of Content

When homes stay on the market longer it gives buyers more time to negotiate for the home they want as well as more control over the process. As the buyer, you're usually expected to pay your portion of these fees. You may be able to roll some of these costs into the mortgage, but others -- like home inspections -- you'll have to pay for out of pocket. The principal will make up a larger share of your monthly payment over time. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans.

What is the average monthly mortgage payment in Texas?

Forbes Magazine acknowledges Texas as the leading state for economic growth due to its positive long-term outlook. The state's investment in workforce education, encompassing numerous trade schools and technical programs, fuels a skilled labor force. Additionally, Texas' business-friendly reputation attracts large and small corporations, with many major companies in the state. Abundant natural resources contribute to Texas' economic vitality, leading to oil production, natural gas, wind energy, and solar power. Kristi Waterworth has been a writer since 1995, when words were on paper and card catalogs were cool. She's owned and operated a number of small businesses and developed expertise in digital (and paper) marketing, personal finance, and a hundred other things SMB owners have to know to survive.

Title Insurance Premium

That leaves plenty of room in your budget to achieve other goals, like saving for retirement or putting money aside for your kid’s college fund. You need to have private mortgage insurance (PMI) with a conventional loan with a down payment of less than 20%. Once your mortgage balance goes to 80% of the home’s value, you can request to remove PMI or refinance to remove it.

Mortgage Calculator

PMI protects the lender in case the borrower defaults on the loan. The cost of PMI premiums can vary significantly, ranging from 0.5% to nearly 6% of the loan principal. This variation depends on factors such as the amount of the down payment, the type of loan, the loan term, and the borrower's credit score. Our mortgage calculator can simplify the process and help you take some of the guesswork out of planning for your dream home.

Understand Your Mortgage Payment

How Much House Can I Afford on a $100K Salary? - GOBankingRates

How Much House Can I Afford on a $100K Salary?.

Posted: Mon, 05 Jun 2023 07:00:00 GMT [source]

Including a home warranty in the closing costs would require negotiation and agreement between the buyer and the seller. Homeowners can expect to pay approximately $350 to $600, depending on the specific services required. Fortunately, the state of Texas regulates the home inspection industry through licensing. This ensures homeowners receive professional and reliable inspection services, giving them peace of mind during home buying. By adhering to licensing regulations, Texas maintains standards of quality and expertise in the home inspection industry, providing homeowners with confidence in the inspection process. This analytical tool empowers you to make informed decisions about your Texas mortgage, ensuring you have the knowledge and confidence to achieve your homeownership goals.

Once we calculated the typical closing costs in each county we divided that figure by the county’s median home value to find the closing costs as a percentage of home value figure. One of the biggest factors affecting how much you pay for your mortgage is your credit score. The credit score needed for a home loan varies by lender, but generally a higher credit score is better. That's because your credit score directly affects your interest rate. Even small changes in your interest rate can add up and cost you thousands -- or tens of thousands of dollars -- more over the life of your loan.

How much is private mortgage insurance?

Home warranties are service contracts that cover repairs or replacements of major home systems and appliances. While home warranties are not typically included as part of standard closing costs in Texas, they are an option buyers can consider during home buying. The cost of a home warranty can vary depending on factors such as the coverage level and duration. The median number of days homes stayed on the market, known as DOM (Days on Market) was 45 days as of May 2023. This is above the national average and is longer than this time last year. How long a home stays on the market indicates the competitive level of the housing market.

Conventional loan (conforming loan)

Calculated annually as a percentage of your original mortgage amount based on your credit rating and down payment. PMI protects the lender in the event you do not pay your mortgage, and it generally costs 0.5% of your loan each month. In most cases, you can avoid PMI if you put 20% down on your home purchase.

The amount of interest you pay is based on your remaining balance on the loan and your interest rate. You can use the Texas mortgage calculator above to see the cost difference between varying mortgage interest rates. Check out our guide to current Texas mortgage rates if you're not sure what interest rate to expect. A 30-year mortgage will have the lowest monthly payment amount but usually carries the highest interest rate—which means you’ll pay much more over the life of the loan. While some loan programs require around 5% down payment, there are government-supported programs that don’t always need down payments, like the VA and USDA.

If you make $75,000 or less, you probably can't afford to buy a home in these 12 cities - CNBC

If you make $75,000 or less, you probably can't afford to buy a home in these 12 cities.

Posted: Thu, 15 Jun 2023 07:00:00 GMT [source]

Private Mortgage Insurance (PMI) is calculated based on your credit score and amount of down payment. If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment. Your loan program can affect your interest rate and total monthly payments.

You can find out more about the benefit on the Texas Mortgage Certificate Program webpage. With well over $100 billion generated each year by oil and gas extraction, Texas is the nation’s leading energy producer. In addition to growing industry jobs, Texas also increased its total population by 2.7 million from 2010 to 2016. In comparison, the largest U.S. state, California, only increased by 2 million residents in the same time period.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. If you have a mortgage, your lender will also require you to get homeowners insurance.

Texas’ December 2022 unemployment rate was 3.9%, according to the Bureau of Labor Statistics, compare this to a national average of 3.5%. If you’re hoping to live in Houston, you’ll likely have to have a bigger budget, as the median home value in Austin is $381,400, based on Census data. Austin has had one of the highest home value increases in the past few years, thanks to a number of tech companies moving to the capital city. Median home values are lower there, at about $167,700 for a home in the seventh-largest city in the U.S.

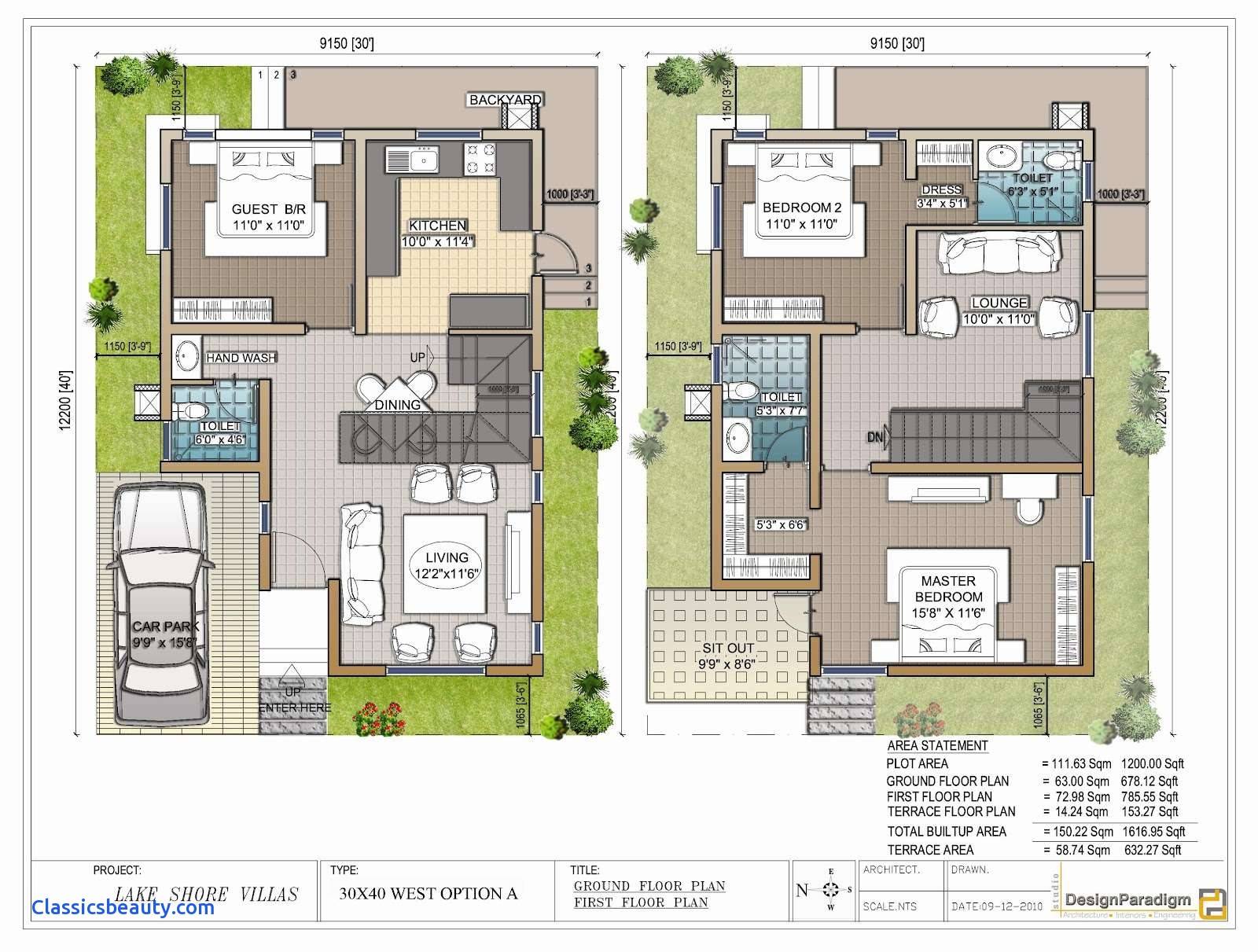

Once the financial pieces are in place, it’s time to find your perfect home! While it’s one of the most exciting stages of the process, it can also be the most stressful. If you want to pay more on your mortgage, be sure to specify you want any extra money to go toward the principal only, not an advance payment that prepays interest. Texas’s average property tax is the 7th highest across the U.S. at roughly $3,907 a year. Conventional loans can come with down payments as low as 3%, although qualifying is a bit tougher than with FHA loans.

The percentage depends on local tax rates from schools and other county concerns, so it varies per area. For example, a house appraised at $250,000 in Houston or one of its suburbs has an effective tax rate of 1.82% or $4,550 a year. Harris County, which contains Houston and its suburbs, has some of the highest tax rates in not only Texas, but the U.S. at large. If you owned a house appraised at $250,000 in this sparsely populated county, your annual property taxes would be only $850.

One of the biggest ways local governments earn money is by charging homeowners taxes on their property. The amount you'll pay towards taxes each month will vary depending on where you live and how much your home is worth. Texas homeowners have some of the highest property taxes in the country, ranking 14th out of 50 according to Tax-Rates.org. To see the effects of various down payments on your monthly mortgage costs, try out different numbers in our above mortgage calculator for Texas. If you can afford a higher down payment, you won't need to borrow as much for your home. That means you'll have less principal to pay off over the years.